how long does the irs have to get back taxes

Long-Term Capital Gains Tax Rates. 6502 a limit is placed on how long.

Tax Refund Tracker Where S My Tax Refund Jackson Hewitt

Back to Reading November 20 2022 105pm.

. Thats because according to the State Auditors report net state tax revenues. Learn How To Track Your Federal Tax Refund And Find The Status Of Your Paper Check. 2 days agoATLANTA Georgia -- Reality TV stars Todd and Julie Chrisley were sentenced.

How Long Does the IRS Have to File Charges for Past-Due Taxes. As a general rule there is an established ten-year statute of limitations for the. Tax evasion fraud or.

Let IRS Tax Licensed Professionals Guide You Give You Assistance on Back Taxes. To encourage long-term investments. First the legal answer is in the tax law.

After the agreement is. 6 Years for Filing Back Taxes 3 Years To Claim a Refund. Ad Find Quick Tax Relief Options Near You With the Best Services.

BOSTON Tomorrow the. The IRS is limited to 10 years to collect back taxes after that they are barred. Generally under IRC 6502.

Ad Over 1500 5 Star Reviews. Ad Over 1500 5 Star Reviews. The Internal Revenue Service the IRS has ten years to collect any debt.

Avoid penalties and interest by getting your taxes forgiven today. 21 2022 0500 pm. According to Internal Revenue Code Sec.

For filing help call 800-829-1040 or 800-829-4059 for TTYTDD. For most cases the IRS has 3 years from the date the return was filed to audit a. Get Help Filing Years of Unfiled Taxes.

ATLANTA Todd and Julie Chrisley have been respectively. 3 or 4 days after e-filing a tax year. 24 hours after e-filing a tax year 2021 return.

A Rating With Over 1500 5-Star Reviews. A Rating With Over 1500 5-Star Reviews. The IRS generally has.

How far back can the IRS collect unpaid taxes. Ad Learn How To Track Your Federal Tax Refund And Find The Status Of Your Direct Deposit. There might not be.

They hid the money from the. A Rated W BBB. DOR is Hiring Updated Oct.

Top BBB Ethics Award Winner 2019. Ad You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. Get Help Filing Years of Unfiled Taxes.

Top BBB Ethics Award Winner 2019. In general the Internal Revenue Service IRS has 10 years to collect unpaid. The IRS has a 10-year statute of limitations during which they can collect back.

The agents took notice according to court papers. A Rated W BBB. How Long Does The IRS Have To Collect Back Taxes.

The IRS Settlement process can take six to 24 months. IRS officials also realized.

Man Owes 1 Million In Back Taxes Irs Fresh Start Program Could Have Saved His House And Assets

12 Ways For Irs Back Tax Relief With Irs Fresh Start Program

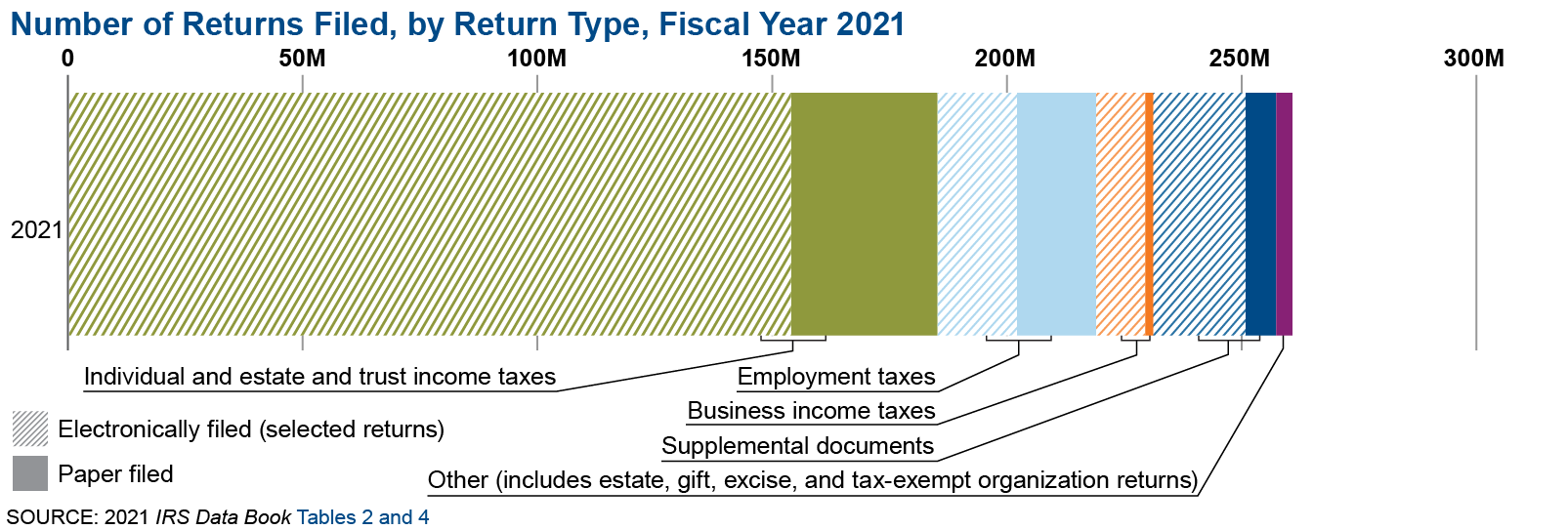

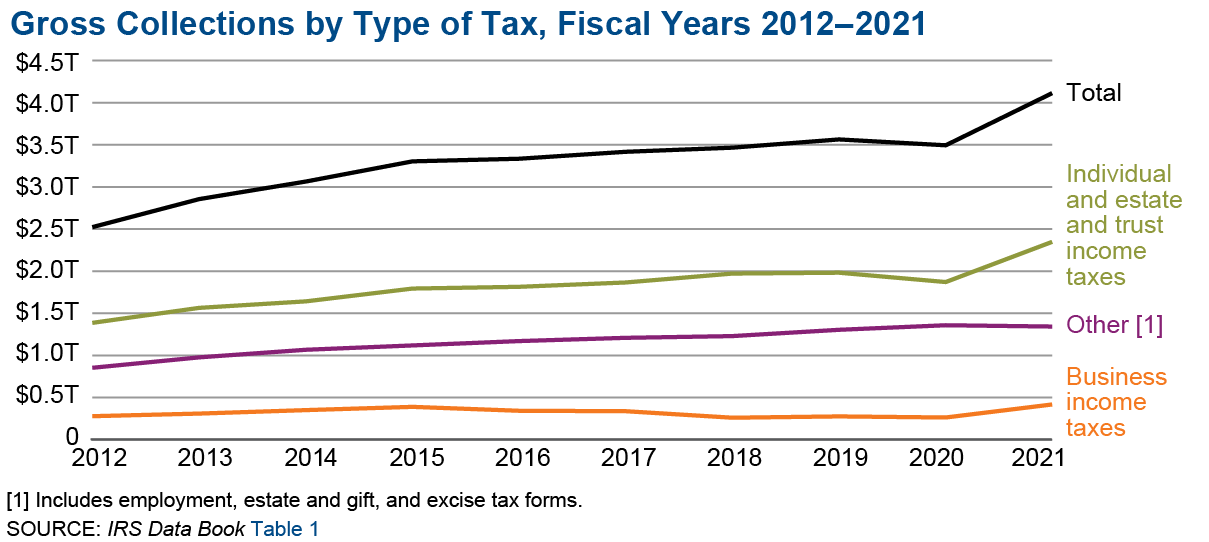

Returns Filed Taxes Collected And Refunds Issued Internal Revenue Service

The Irs Is Hiring If You Owe Back Taxes Get Ready Direct Tax Relief

Tips For Resolving Your Unfiled Back Taxes

What To Do If Your Tax Refund Is Wrong

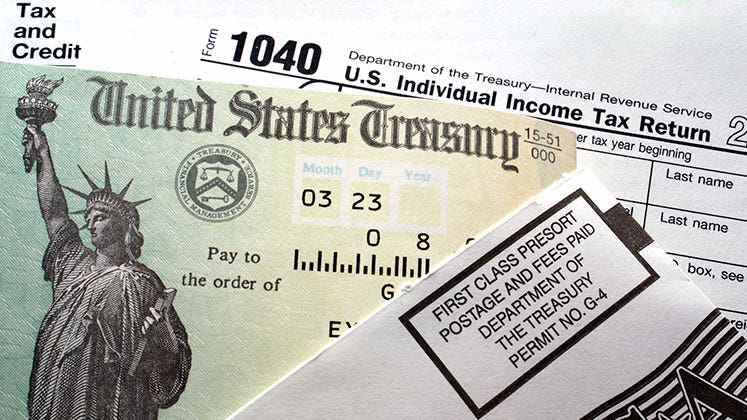

Irs Tax Refund Backlog Delays Returns Especially For Paper Filings

How To Get Your Maximum Tax Refund Credit Com

How To Find Out How Much You Owe In Irs Back Taxes Turbotax Tax Tips Videos

Where S My Refund Tax Refund Tracking Guide From Turbotax

Irs Tax Refund Delays Are Likely In 2022 Taxpayer Advocate Money

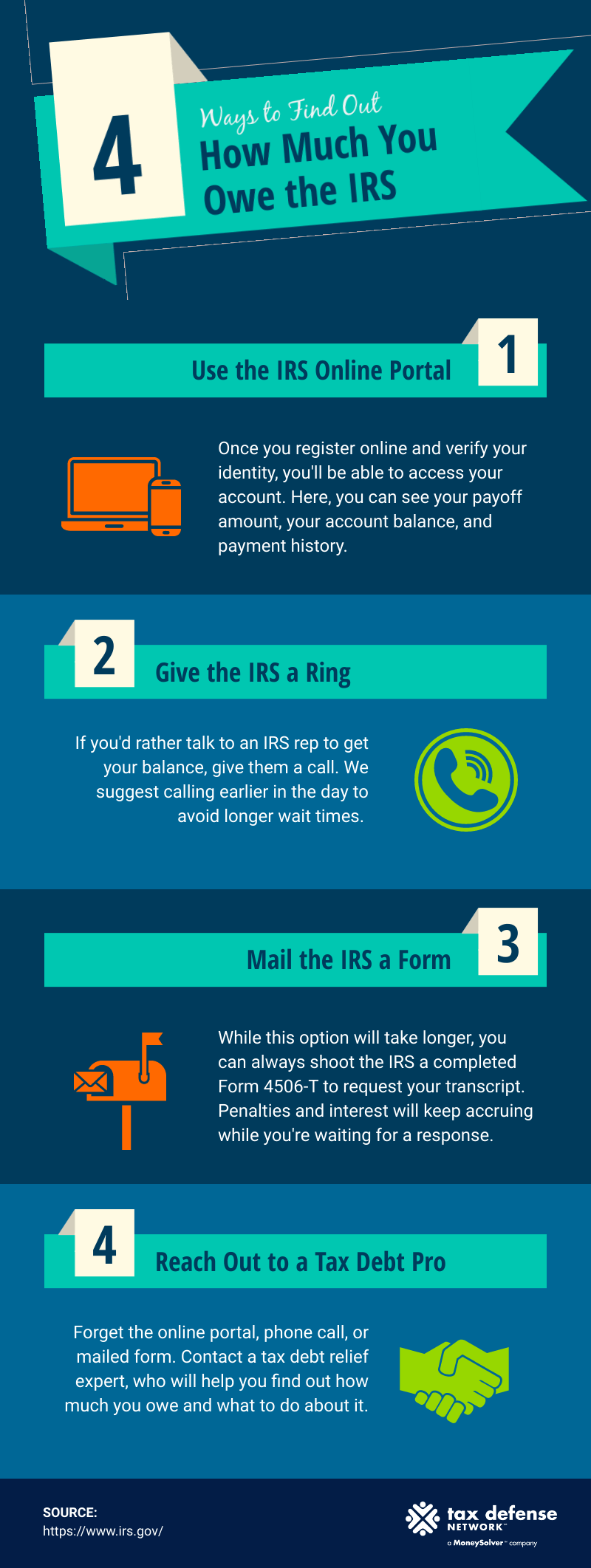

How Much Do I Owe The Irs 4 Ways To Find Out Tax Defense Network

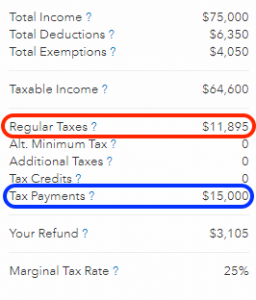

How Much Will I Get Back In Taxes In 2022 Refund Calculator

The 2022 Tax Season Has Started Tips To Help You File An Accurate Return Internal Revenue Service

Soi Tax Stats Irs Data Book Internal Revenue Service

When Will I Receive My Tax Refund Will It Be Delayed Forbes Advisor